Our services A modern take on financial advisement

Curo are committed to providing all of our clients with the highest quality ongoing service. We don’t just provide advice and implement financial solutions we work with you over the long term to make sure that your money is working as hard as it possibly can.

Independent financial advisers

As independent financial advisers, we are constantly reviewing all the investment propositions within this very busy market place. We have completed our annual due diligence report and are still happy to recommend True Potential investments as our investment partner. Their Wealth Platform offers a wide range of investment options to meet our clients’ needs. You can invest capital within innovative risk-based strategy funds from world-class investment managers, and our own Wealth Strategy Fund Range and Managed Portfolio Series.

The Financial Conduct Authority do not regulate tax planning or trust planning.

Investments

We believe everyone should be investing their money, even if it is just a small amount to begin with. Whether you are saving up for a particular life event or are looking to protect your future, we will help you navigate this process and build a solid financial profile.

Our advice is always goal-based and we will take the time to understand your end goal then help you achieve this with as little risk as possible. Your financial security is at the forefront of any decision and we will only advise you on investments that are inline with your risk profile.

- Regular and Lump Sum investment

- Enterprise Investment Schemes

- Individual Savings Accounts

- Advising on Power of Attorney

- OEICS and Unit Trust investments

- Investment Planning review service

- Investment Bonds

- Bespoke Portfolio Planning Service

- Venture Capital Trusts

- Tax efficient investments

Your investment value can rise as well as fall. Your capital is at risk.

Retirement Planning

With healthcare constantly developing, people are living for much longer and finding themselves financially compromised when their pension runs out. Early consideration of your future finances is key to a comfortable retirement, free of money worries. As state pensions can be uncertain, it is wise to have other investments in place that will contribute to a long-term income stream.

Pension and retirement plans are ever-evolving to keep up with these changes, with sophisticated solutions available. We can help you review your options and ensure you choose the right path for a secure financial future.

- Pensions for Children

- Retirement planning solutions

- Stakeholder Pensions

- Assessment and review service

- Personal Pensions

- Legislative and tax planning advice

- Self Invested Personal Pensions

- Tax efficient income in Retirement

- Annuity Purchase Review

- Income drawdown

Your investment value can rise as well as fall. Your capital is at risk.

Mortgage advice

Curo Mortgages are able to offer you advice and solutions from the whole of the market. This means that, unlike the banks, online internet sites and a lot of other mortgage brokers who work off a panel of lenders, we can research all the mortgages that are available.

- First time buyers

- Life time mortgages

- Help to buy scheme

- Buy to let mortgages

- Remortgage

- Commercial lending

- Self-build mortgages

- Right to buy mortgages

- Equity release mortgages

- Second charge lending

You will need to keep up Mortgage payments or your home may be repossessed.

Lifestyle protection

We can provide you with expert advice on the most effective means of protecting your financial future and the long-term wellbeing of your family should any difficult circumstances arise. Products to consider for this area of your financial planning may well include:

- Individual and Family protection

- Income Protection

- Life Assurance

- Personal Accident and Sickness Cover

- Relevant life plans

- Mortgage Protection

- Inheritance tax planning

- Whole of Life

- Critical illness

If you do not keep up with premium payments, your protection policy will cease.

Inheritance Tax Planning

Protecting your wealth is just as important as optimising your wealth. Managing your inheritance and mitigating potential future tax liabilities can be a complex process but it is vital to ensure your loved ones and assets are looked after. We work with specialist partners to carry out careful planning when it comes to the estate you will leave behind.

- Inheritance Tax Planning Review Services

- Discounted Gift Trusts

- Gift and Loan Trust arrangements

- Specialist Inheritance Tax Planning Schemes

- Trust planning service

The Financial Conduct Authority do not regulate tax planning or trust planning.

Will writing

As part of complete investment portfolio, it is essential to have a correctly worded will in place. At Curo Wealth we have an in-house Will Writer to provide advice on Wills and Estate Planning.

At its most basic level a Will allows you to do three things:

- Appoint the people you trust to administer your estate on death

- Appoint people as guardians for your minor children

- To control who received your estate and when they receive it

Without a will in place, you will have no control over these matters, the state will decide these things for you.

Inheritance Tax is the only tax we can legally avoid arranging a Will is the first step to ensuring your estate passes to your loved ones in the most tax efficient manner possible.

Lasting Power of Attorney

Lasting Power of Attorney deal with loss of Mental Capacity as defined by the Mental Capacity Act 2005.

There are two types of Lasting Power of Attorney, one deals with your Property and Financial Affairs and the other deals with your Health and Welfare decisions.

Without these documents in place, any decisions regarding your personal finances or personal welfare would be made by your Local Authority.

The introduction of GDPR (Data Protection Rules) in May 2018, made having a Lasting Power of Attorney in place pretty much essential.

Pension Transfers

Take control of your pension. We will help you find your old pensions and transfer them to our platform. You will then have live access to view your balance and you can easily add contributions.

Your investment value can rise as well as fall. Your capital is at risk.

We aim to earn the trust and respect of our clients through expert knowledge and awareness of industry developments.

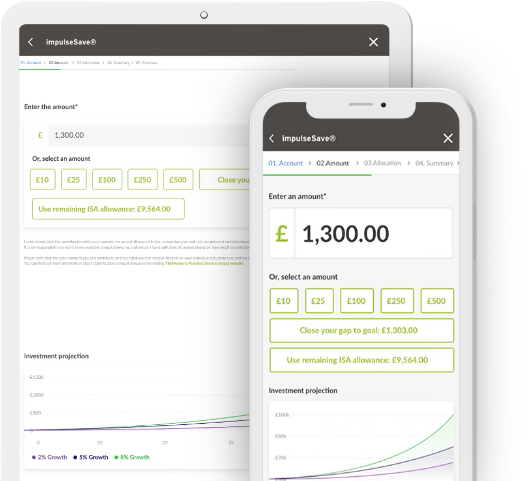

Your investments at your fingertips

Need 24/7 access to Curo? Download the app today and manage, track and deposit with the touch of a button.